Investment Banking Capabilities

Since the original formation of our team in 2008, we have been involved in over $20 billion of transactions across a wide range of industries. Our services include capital raising, mergers and acquisitions, special situations and restructuring and financial advisory. We deliver the expertise found in large bulge bracket investment banks with the tailored attention and creativity of a boutique, providing a broad range of services to help middle market companies navigate all critical stages of their business. In each case, we help clients evaluate their options, develop the right strategy and execute transactions that drive value.

- Growth equity for mid‐to late stage companies

- Pre‐IPO capital raises

- Common stock, preferred stock & convertible preferred

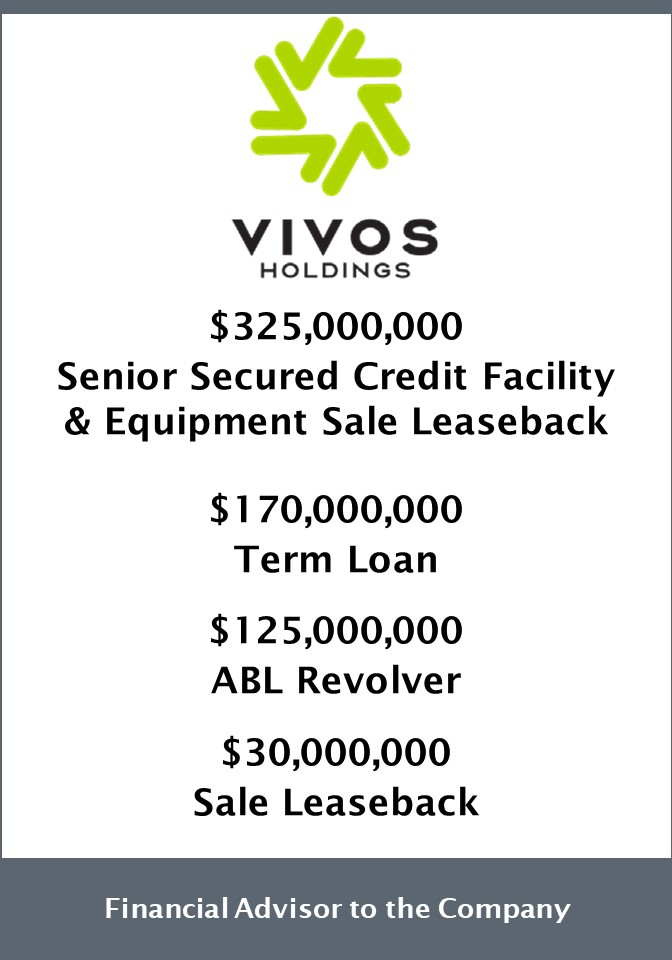

- First lien, second lien, and "lastout" financing

- Mezzanine & subordinated debt

- High yield debt

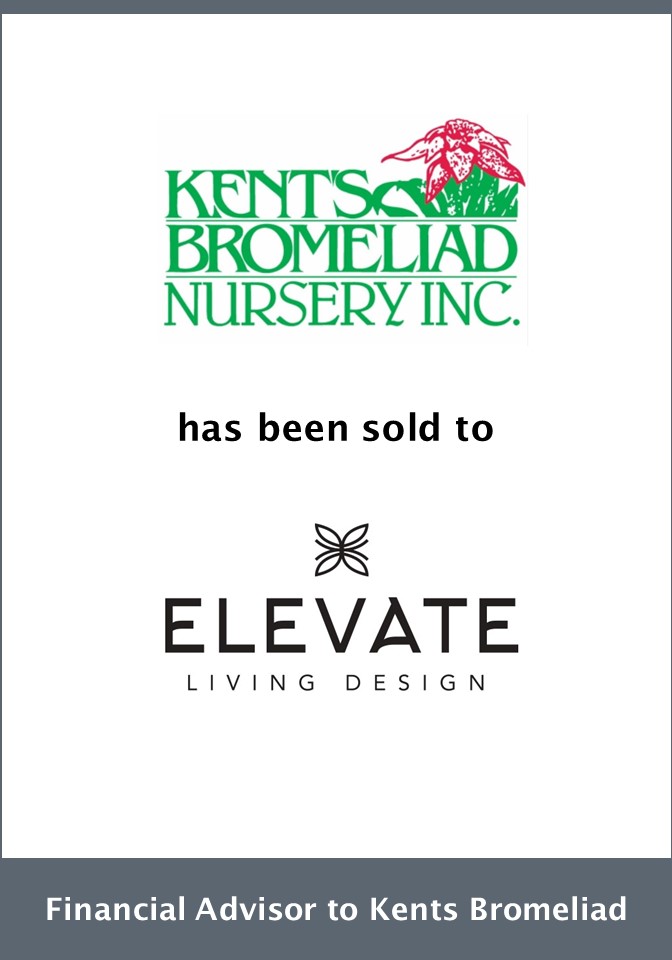

- Sell‐side advisory

- Buy‐side advisory

- Divestitures

- Fairness opinions

- Mergers

- Joint ventures

- Strategic alliances

- Leveraged buyouts

- Board & special committee advisory

- Restructurings & workouts

- Tender and exchange offers

- Credit agreement and bond renegotiation

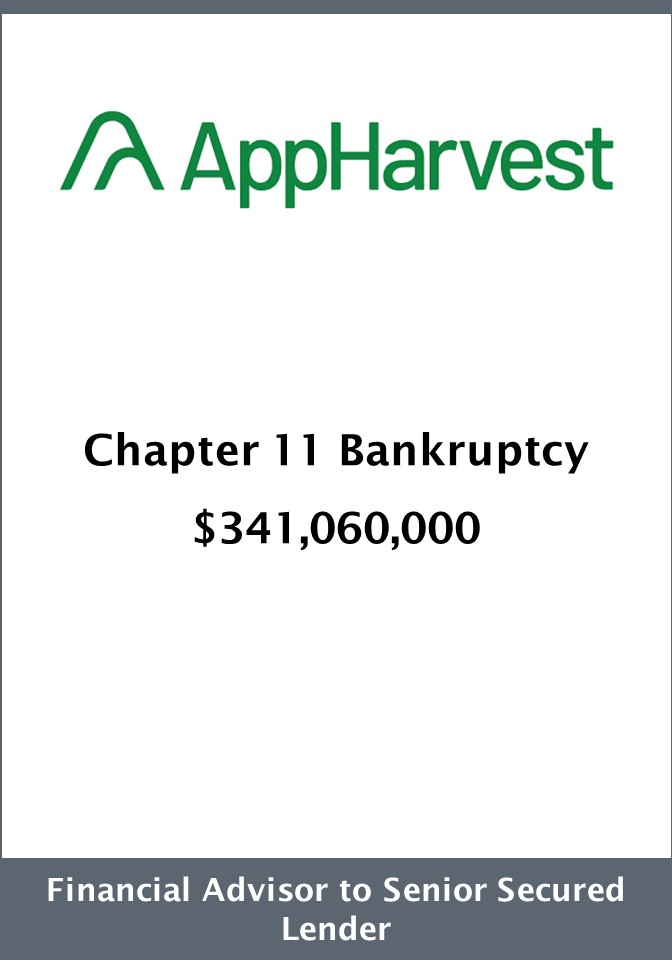

- Chapter 11 advisory

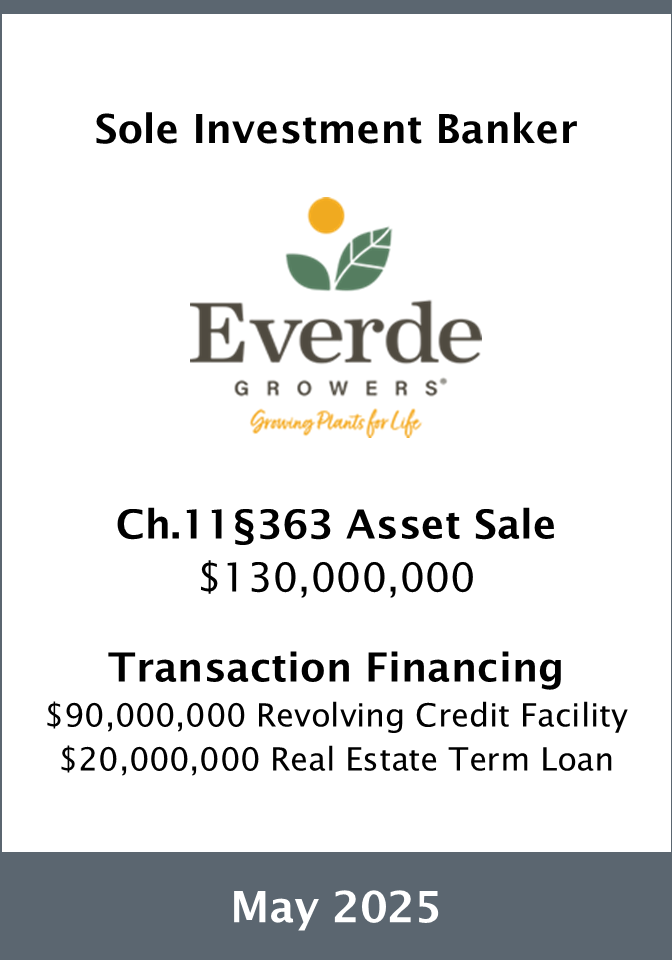

- §363 sales and auctions

- Rescue, DIP and exit financing

- Strategic financial and advisory services

- Business plan analysis

- Industry and capital market analysis

- Transaction analysis and support

- Synergy analysis

Extensive Transaction Experience

*Some transactions executed by principals of Armory while at prior firms.